Snapshot of Results

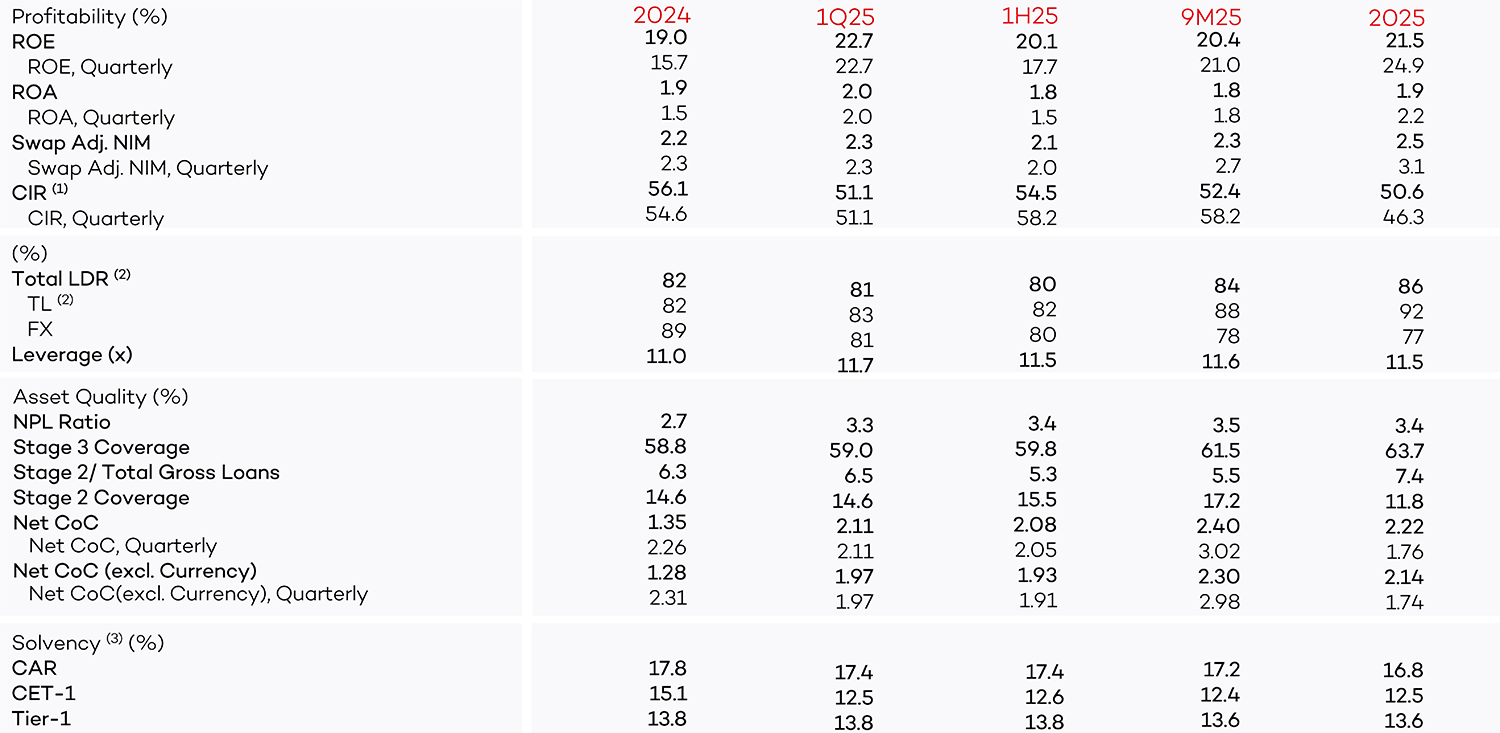

(1) CIR calculation excludes FX gain from hedge position related with stage 1&2 provisions

(2) Bank-only, TL LDR includes domestic TL bond issuances and merchant payables

(3) w/o forbearances. Forbearances: fixing MtM losses of securities & FX rate for RWA calculation to 26.06.2023 FX rate for 2024, 28.06.2024 FX rate for 2025

Balance Sheet Highlights

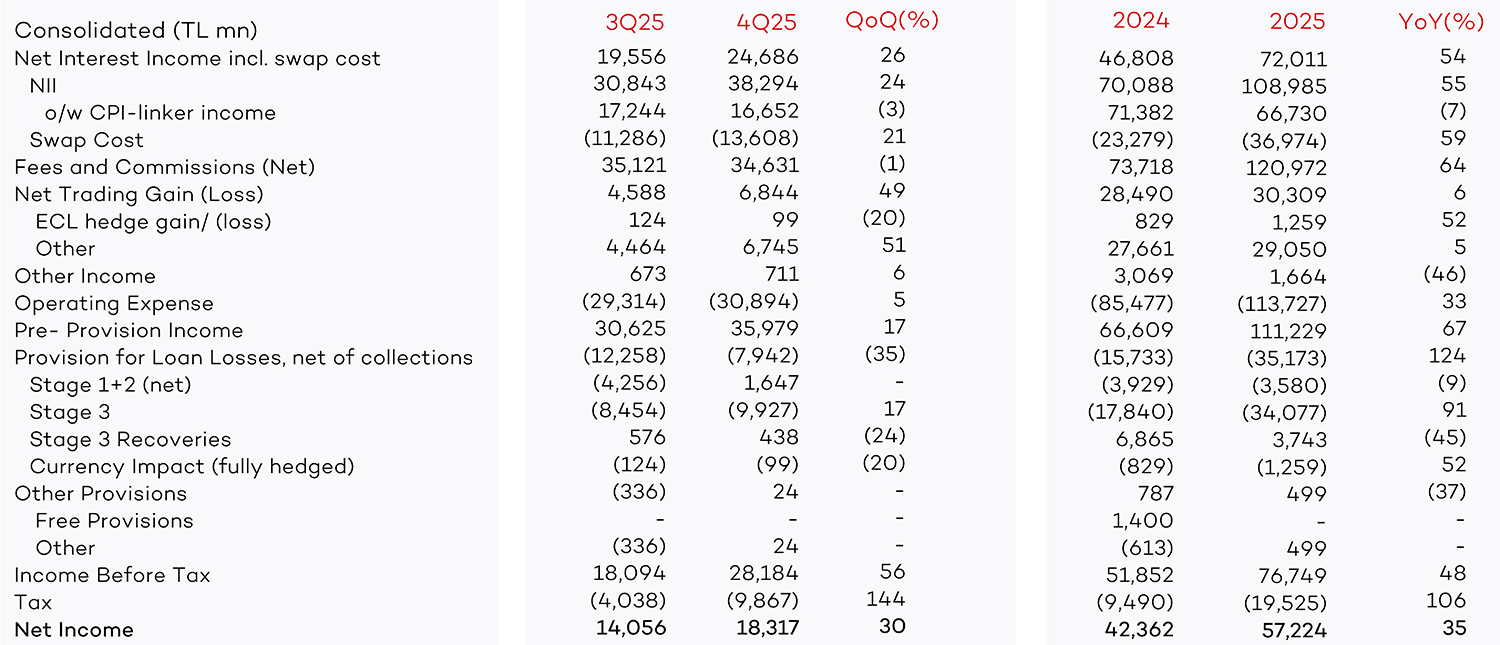

Income Statement Highlights