According to the statistics of the World Bank, approximately 70% of the population in Türkiye consists of people who have bank accounts. About half of this segment consists of people who are “semi-banking savvy”, that is, people who use 1 or 2 products in their relations with banks, make an average of 2 or fewer transactions per month, and who cannot really benefit from the services of the financial system.

As Akbank, we are aware that customers can be with limited access to financial resources, still have a preference of using physical channels for financial transactions, and/or have room for improvement in financial literacy. Akbank continues to make financial inclusion a part of its business model with expanding its products and services according to the needs and preferences of underserved groups within the framework of Ecosystem Management, one of the 4 focus areas of its sustainability strategy.

In this context, as Akbank, we continue our efforts to increase the number of individuals and institutions we financially empower by 2030. We have one of the largest ATM networks in Türkiye; we are easily accessible with 6210 ATMs spread over a wide geographical area.

FINANCIAL PRODUCTS & SERVICES

Women MSMEs and Women Entrepreneurs

In 2024, we aim to be the biggest supporters of Micro, Small and Medium Enterprises (MSMEs) in their green transformation journey. In this context, we enable MSMEs to identify their status and areas of development with carbon footprint measurement and company ESG analysis applications. At Akbank, we are aware that financial health and inclusion are one of our most important areas of impact. In this context, as one of 28 banks worldwide, we are delighted to be a founding signatory of the UNEP FI Financial Health and Inclusion Pledge, which aims to promote financial health and inclusion in collaboration with the United Nations Environment Programme Finance Initiative (UNEP FI).

As a signatory to the first-of-its-kind initiative, Akbank has committed to regularly disclosing measurable targets and our performance in line with financial health and inclusion, over 18 months. In this context, by 2025, Akbank aims to achieve a growth rate of 10% per year on the number of women-led MSMEs customers that have access to min. 1 financial product that they didn’t have access to in the past year and that helps increase financial resilience or support sustainable business growth. This commitment involves providing these customers with an additional product that they didn't have access to previously, which will enhance their financial resilience and promote sustainable growth.

In line with the Sustainable Development Goals, and Türkiye’s 12th Development Plan, we aim to provide products that will encourage the sustainable growth of our women owned/managed MSME customers by increasing their financial resilience. We expanded our customer base with our financial and non-financial products and services increased the number of active women MSMEs by 19% in 2024 compared to the previous year. We have doubled our customer base and increased our loan balance by 7 times.

In 2023, we took action with the European Bank for Reconstruction and Development (EBRD) and the Credit Guarantee Fund (CGF) to support woman business owners and entrepreneurs and facilitate their access to finance. Within the scope of the Financing and Consultancy Support Program for Women’s Enterprises, we offered our “Women SME Package”, which is the first and most comprehensive package specially designed for SMEs within the scope of sustainability, with USD 100 million of EBRD resources and 80% CGF collateral support, to SMEs whose founders or managers are women who have difficulty in creating collateral. With this package, we not only provide a solution to the collateral problem, but also provide the necessary mentoring, consultancy and training free of charge after the financing needs are met.

In 2024, we provided a total of USD 238 million in loans to the Women SME segment through international funds.

In collaboration with Export Development Inc. (İGE), we launched the İGEAkbank Green Transition Finance Support Package, granting loans of up to TRY 18.7 million to SMEs for green transformation projects, backed by an 80% İGE guarantee. This partnership with İGE represents a first in the sector, as it is the only green transformation product exclusively developed by a guarantee institution and a commercial bank. While other guaranteed financial products have been created in collaboration with multiple banks, this initiative is solely between İGE and Akbank, reinforcing our commitment to driving sustainable transformation among SMEs.

In addition, we are involved in a project with Proparco that will promote green projects and women’s entrepreneurship in Türkiye. With the funding we receive from Proparco, we aim to further expand our support to MSMEs for women’s entrepreneurship. With this goal, we contribute to the Gender Equality Goal No. 5, which is among the United Nations Sustainable Development Goals.

With the aim of switching to a mentoring model that will benefit more women entrepreneurs free of charge, we announced the BinYaprak Women Entrepreneur Mentorship Program with Turkishwin on November 19, International Women’s Entrepreneurship Day. In 2024, we were provided 100 women SMEs with free one-on-one mentorship through the "Binyaprak Women’s SME Mentorship Program" in collaboration with Turkishwin, extending the same support to 100 additional women SMEs in 2025.

You can access the inspiring story of Egeyurt Group, one of our women-owned/managed MSMEs we support, from the link: https://youtu.be/Ow2Mgo2xVEk

Venture Banking

We have completed our work aimed at providing customized services for start-ups and techno start-ups and we have opened special branches in Istanbul Maslak, Batı Ataşehir and Ankara Ümitköy, where we will offer these services. In order to provide our services more quickly and effectively, we have collaborated with 8 techno parks/ science parks, 6 acceleration and incubation centers and 1 crowdfunding platform. In addition, we focused on identifying potential customers by filtering them according to the needs of the target audience, through our memberships on 4 different platforms.

In 2023, we sponsored the Istanbul Technical University Big Bang event and brought 17 entrepreneurs together with the relevant units within Akbank. For 2024, we have completed the sponsorship and participation processes for 11 different events that will be attended by approximately 1000 people.

We’re also building a strategic partnership with Ak Asset Management and the ARYA Investment Platform to offer tech startups and entrepreneurs comprehensive services. Startups can access not only the necessary financial products but also mentorship, networking, and consulting services from a single source. In collaboration with Ak Asset Management, we have established a venture capital fund worth USD 20 million, which also supports Akbank's Venture Banking customers. Additionally, through our partnership with the ARYA Investment Platform, we have created a system that connects Akbank's Venture Banking customers with mentors and angel investors.

In order to support the rent payments and R&D project costs, we started to offer a series of product packages such as chip-money support to start-ups operating in techno parks and science parks, advantageous commission rates in virtual POSs, special budgets for salary agreements, advantageous commission rates for letters of guarantee, and zero-interest Plus Money. In addition, we offer loan options that are specially designed for Akbank entrepreneurs and suitable for loan approval processes for start-ups and techno-entrepreneurs, by evaluating them according to their start-up business plans.

In our non-banking services, we provide special advantages to our entrepreneurs by cooperating with companies such as Microsoft, Kolektif House, Mükellef, Workhy, Usemagnetiq, Parachute, Aköde, Malogra, and MG Legal.

We hosted four workshops, one academy, one mentor check-up, and one investment preparation program for technopreneurs, totaling seven programs. We received over 1,000 techno-startup apps, with more than 300 benefiting from the programs. Around TRY 60 million in TÜBİTAK BiGG investment was secured by 66 entrepreneurs who chose Akbank's Entrepreneurial Banking.

In the 6th round of the "Boost the Future" entrepreneurship acceleration program, organized in collaboration with Akbank and Endeavor Türkiye, we provided a comprehensive three-month mentoring and training program to 10 startups that have the potential to change a number of industries, including accessibility, financial technologies, AI, and sustainability.

In the 10th round of the CaseCampuses Bootcamp Live Program, organized in collaboration with Endeavor, we inspired young people's entrepreneurial journeys with a special three-day training program lasting 14 hours. With a broad curriculum of real-life case studies and workshops on entrepreneurship and innovation, the program graduated a total of 600 alumni, including 52 new graduates in 2024.

In 2025, we will continue to spread and expand the scope of our Venture Banking activities at full steam.

Youth Banking

We are aware of the social and financial needs of young people in order to prepare them for the future in the best way and help them improve themselves in all areas. As Akbank, we consider young people under two different categories, namely “Those Who Are about To Start Out in Life” and “Those Who Have Just Started Out in Life”. We aim to increase the loyalty of groups by providing value propositions that meet different financial and social needs. We make sure that young people are informed about financial issues when they start out in life and that they can make the right decisions about their budgets. For this purpose, we continue to work intensively to increase the level of “financial literacy” so that young people can turn to the right-investments and savings. We continue to offer advantages for young people's first loan needs.

In 2020, we changed the name of the “Akbank FAV” program, which offers a digital experience for university students, to “Undergraduate Akbanker”, and we are facilitating the access of university students between the ages of 18-26 to financial transactions by offering them free banking transactions and free overdraft accounts.

Over the past three years, our young customer base has grown 2.3 times, with the number of university students increasing 3.3 times. Since the relaunch, the number of active customers in the University Students with Akbank program has risen 2.4 times—and continues to grow.

Also, with our financial inclusion perspective, we achieved +9% year-on-year growth in active young customers in 2024, and we aim to continue to grow in 2025 in terms of young customers, especially students. In addition, our youth banking loans, loan amounts and the number of beneficiaries can be found on page 30 of the Akbank Sustainable Finance Allocation Report

Our Special Privileges for Pensioners

Within the framework of our efforts to expand our Social Security Institution (SSI)-retired customer base, we managed to increase the number of our SSI-retired customers, which we already quadrupled in 2022, by over 20% in 2023. Throughout the year, we continued to make attractive promotional offers to our customers who wanted to receive their SSI pensions at our bank. We also allowed them to withdraw their salaries from their accounts two days before the due date of their salaries. Our customers who have a plus money-limit in their pension accounts and receive their salaries from our bank can benefit from this advantage. Our customers are offered the opportunity to use the existing surplus money limits interest-free in the period between two days before the salary due date and the salary payment date. In this way, our customers have the chance to easily and conveniently avoid the cash crunch experienced in the last days before their next pensions are due.

Our Accessible Banking Approach

We prioritize equal access to banking services for all our customers and continue our impactful collaboration with BlindLook, a social enterprise that develops technologies for the visually impaired. Thanks to BlindLook's voice simulation technology, our visually impaired customers can now navigate Akbank Mobile and Internet with greater ease. Moreover, as part of our ongoing efforts since 2023, we are working on integrating accessible versions of all banking contracts and request forms on our website, available in both voice and sign language for our hearing and visually impaired customers.

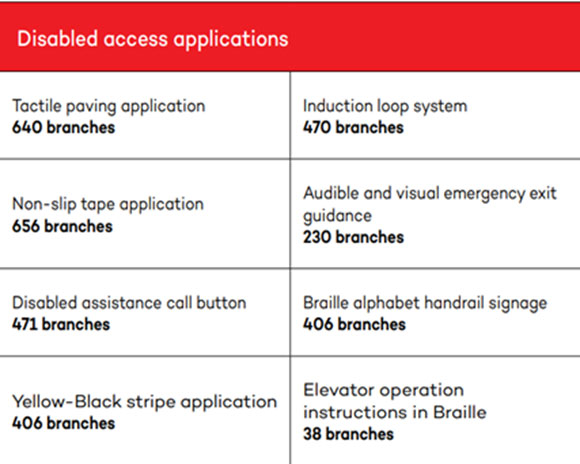

Through the "Inclusive and Barrier-Free Communication" e-training, available to all bank employees, we continue to foster effective communication with our employees and customers with disabilities. Accessibility features for the disabled are available across all 98 of our branches.

OUR NON-FINANCIAL SUPPORT

Financial Literacy

With Akbank Mobile, we support both our retail banking and MSME customers to become individuals with better financial health, while raising awareness about their financial situation with the renewed ‘For You” tab. We facilitate financial management with the smart suggestions and insights we offer.

We offer financial notifications and more than 45 tutorial videos to our customers through our website, YouTube and many channels to more than 35 million people per month from Akbank Mobile.

We published our 10-episode podcast series, in which we discussed financial literacy, behavioral finance, inflation, investment, financial technologies and many other topics, and which was moderated by Attila Köksal, President of the Financial Literacy Association and was broadcast in cooperation with Aposto. You can access our podcast series from this link: Attila Köksal ile Finansal Bakış on Apple Podcasts

Expanding our financial literacy mission, we introduced quiz content in the Akbank Mobile Story section to enhance financial knowledge. Through Microfon.co, Türkiye's largest education financing platform, we provide financial literacy training for young people and offer these trainings as a gift to our new customers. Additionally, in collaboration with FODER, we organize financial seminars for retirees and housewives, raising awareness on savings, wealth accumulation, and investment strategies.

Our TOSLA Application

Through the TOSLA app by our subsidiary AkÖde, we have broadened the financial services available to both individual and corporate customers. With HHS (Account Service Providers) certification, users can now link their Tosla accounts to various bank and wallet apps, allowing them to monitor their account activity.

Our partnership with Sabancı University, which began with Tosla-branded identity cards, has expanded into a digital identity card project with Sinop University. In line with our sustainability goals, we continue to offer eco-friendly solutions through digital card initiatives. In February, we introduced the Tosla İşim brand, marking a significant advancement in meeting the payment service needs of our commercial customers.

We launched innovative solutions such as Virtual POS, Payment Link, Cash Register POS, and Credit Payment Gateway, designed specifically for SMEs and businesses. Furthermore, we enhanced users' financial experiences by offering embedded wallet services for e-commerce and marketplaces. Through these innovations, we remain committed to accelerating and simplifying access to financial services for both individual users and businesses.

Transformation Academy

We established the Akbank Transformation Academy in order to digitalize and financially empower our SMEs. It supports our SMEs in financial and digital transformation with seminars, personalized training programs, and networking opportunities, helping them stay up to date with hot topics. In addition, thanks to the academy, all our SMEs can benefit from various training programs. We started to offer these training programs in Ankara, Gaziantep, Sakarya, Malatya and Denizli provinces. We continued our training programs in 2024 to support our corporate clients, particularly SMEs. In 2024, we also launched a three-month training program in Sakarya, specifically designed for 10 entrepreneurial women. The Entrepreneurial Women program began with company visits and SWOT analyses and continued with online sessions. At the conclusion of the program, all participants were enrolled in a six-month mentoring process provided by TurkishWIN. We have reached 20,000 SMEs and entrepreneurs since 2022. In 2024, we continued to provide our SMEs with a wide range of training and mentoring services, especially in the areas of green transformation, e-commerce, export and digital marketing, as well as discounted or complimentary access to certain products and services. In this way, we will help our SMEs become stronger and achieve their strategic goals.

Akbank+

With Akbank+, we enable in-house entrepreneurs to work on their ideas on a fulltime basis. While the personal rights of the participants as Akbank employees continue, all participants can also pursue their activities as full-time entrepreneurs. Within the scope of the program, 6 ideas worked on by Akbank employees are studied for the “empathy”, “identification” and “idea generation” steps of the design-thinking methodology during a 10-week incubation phase, and then 3 ideas determined by the presentations to be made to Akbank’s Investment Committee move on to the second phase of the program in 14 weeks and turn into MVPs in line with the “prototype” and “test” steps. We are implementing the program together with GOOINN, which provides consultancy services in the field of innovation and entrepreneurship. In addition, once the business models of the participants are clarified, we create an advisory board that will provide mentorship to them in the process of MVP development and their investment journey.

In this context, the Akbank LAB Innovation Centre People and Culture team, Waste Log, which digitalizes waste processes in the first period of the Akbank+ Program, and Voltla, which improves the experience of electric vehicle owners, received an investment of 500 thousand USD from Akbank In the second phase, an investment of USD 400,000 was made in the Metriqus initiative, which offers an AI-powered analytical platform providing smart marketing insights for mobile game studios. The total investment amount in initiatives developed by Akbank employees reached USD 1.4 million, and 23 Akbank employees earned the title of Innovation Ambassador within the program.

OUR CLEAN BANKING PRINCIPLES

Our bank operates in full compliance with legal regulations, ensuring that all transactions prevent any harm to customers, markets, and stakeholders. We adhere to Clean Banking principles to avoid unfair practices and maintain transparency in our banking activities. We take into account the vulnerabilities of our customers and provide our products and services in a fair, clear, and understandable manner. Additionally, we manage customer complaints effectively, prioritizing customer satisfaction.

Conduct Risk principles, providing necessary training to employees, targeting process and performance management, reward and punishment processes, campaign design processes, customer information before/during and after sales, new product/service design, evaluation and approval process, customer approval, after-sales rights, cancellation/refund processes and customer complaint management.

Care for Vulnerable Customers: Customers who are able to understand and use information about the content, returns and risks of banking products and services to a limited extent due to their age, health status, education level, income level and language of communication are defined as vulnerable. Additional attention is paid to vulnerable customers who are likely to be exposed to Conduct Risk.

For more detail, you can access our Conduct Risk Policy from this link: Conduct Risk Policy (akbankinvestorrelations.com)

Categories of Vulnerable Customers:

Education Level: Customers who cannot perform basic numerical calculations and lack financial literacy due to their educational level.

Health Status: Customers who cannot make timely and accurate decisions due to physical/mental conditions.

Income Level: Customers who cannot perform a sound financial assessment due to low income or financial burden.

Age: Customers with limited financial transaction experience due to their young age, resulting in vulnerability in evaluation competence.

Language Barrier: Customers who do not understand or speak Turkish at a level that allows them to comprehend banking services, returns, and risks.

In addition, our Academy Department organizes training sessions to ensure that Conduct Risk Principles are learned, understood, and applied across the bank. These trainings cover Conduct Risk Principles, cases that violate these principles, and examples of good behavior that could serve as benchmarks. The aim is to promote examples aligned with Conduct Risk Principles and prevent deviations.

In 2023, we continued our Clean Banking efforts, which we carry out to observe the interests of our customers as well as the legal regulations in the practices and conduct of our Bank and its employees towards customers. To manage Clean Banking within the framework of the principles determined in our Bank, to make this concept widespread across the organization, and to adopt it as a working principle, we have implemented many practices in the fields of corporate culture, training, communication, new product/service processes, and customer complaint management.

We continue to identify the areas of improvement and take action in these areas by measuring Clean Banking communication and awareness within the organization, with the help of a survey covering all our employees who come into contact with our customers.

We held meetings with our 7 Regional Directorates to share our findings on Clean Banking practices, to receive feedback, and to adapt our processes accordingly. We carried out 1 focus group study with our branches during the year. On two separate occasions in 2023, we rewarded our successful employees who combined their high performance with their awareness and sensitivity about Clean Banking and thus contributed positively to customer satisfaction.

We ensure that our bank complies with applicable anti-bribery and anti-corruption laws and regulations, clean banking, ethical principles, and universal rules, in all countries where it operates. We continue to work in full compliance with our obligations regarding the prevention of financial crimes. In order to avoid negative situations, we make sure to manage our relations with our stakeholders by paying attention to our Conflict of Interest Policy, to evaluate our customers, transactions, products and services with a risk-based approach, to determine our strategies, relevant control mechanisms and measures, operating rules, and responsibilities to reduce possible risks, and to raise awareness of all our employees on these issues.

You can access our Ethical Principles on our website: https://www.akbankinvestorrelations.com/en/corporate-governance/detail/Ethical-principles/29/8/0

In addition, the Person-to-Person and Team-to-Team Thank You awards are used for Akbank employees to thank each other and their teams for their support during their work. The 10 Number Akbanklı award is given to reward performances that make a difference. Clean Banking award is developed to promote behavior adherence to banking principles during our work. Various applications such as the Star Club are used to reward high performance in the field. In 2024, a total of 4,110 Akbank employees received material and experience rewards through these applications.

STRATEGIC COLLABORATIONS

In 2021, as one of 28 banks worldwide, we are founding signatory of the UNEP FI Financial Health and Inclusion Pledge, which aims to promote financial health and inclusion in collaboration with the United Nations Environment Programme Finance Initiative (UNEP FI). For more information, you can access our target from this link: PRB-Fin-Health-progress-report-1.pdf (unepfi.org)

In 2021, as a signatory of The Valuable 500 initiative, we are the first bank and organization from Türkiye to join the global initiative. Through our corporate culture that is based on the principles of diversity and inclusion, we support the participation of people with disabilities in work life; gender equality and equal opportunities; women’s empowerment and volunteering activities, and equal opportunities in education. For more information, you can access our commitment from this link: AKBANK - The Valuable 500

In 2024, we are the only Turkish bank in the UN Women Gender Equality Working group, a collaboration between UNEP FI and UN Women to support the implementation of the UN Principles for Responsible Banking (PRB), the world's leading sustainable banking framework, in line with the UN Women's Empowerment Principles (WEPs) and other gender-related standards. The sustainable financing solutions and mentoring services our bank provides to women-led businesses and initiatives were recognised as ‘good practice examples’ in the guide published by the Working Group. UN Women - Advancing Gender Equality and Women’s Empowerment

As Akbank, through our membership in the Financial Literacy and Inclusion Association (FODER), we remain committed to advancing financial literacy and ensuring broad access within the community.

FINANCIAL INCLUSION GOVERNANCE

Our bank's Sustainability Committee oversees our all Sustainability efforts including financial inclusion and deeply understands the importance of providing financial services that offer equal access to all segments of society. In addition, the Ecosystem Management Preliminary Committee (including executive vice presidents of Retail, SME Banking and CEO) regularly come together to develop various strategies to ensure that disadvantaged groups can benefit from banking services. Enhancing financial inclusion not only contributes to economic growth but also supports social equity and well-being. In this regard, our efforts in financial inclusion are recognized as a strategic priority in achieving our sustainable development goals.