Introduction

Akbank’s core business is banking activities, consisting of corporate and investment banking, commercial banking, retail banking, treasury, private and international banking services.

With a strong and extensive domestic distribution network with more than 12 thousand employees, Akbank operates from its headquarters in Istanbul and 19 regional directorates across Turkey. Akbank serves more than 14 million active customers by providing services at branch locations, its traditional delivery channel, as well as Akbank Direct Banking, which includes internet and mobile banking service channels, Call Center, more than 6.000ATMs and other digital channels, along with more than 800 thousand POS terminals.

Akbank conducts overseas business operations through its subsidiary in Germany (Akbank AG) and one branch in Malta. The Bank’s affiliates Ak Investment, Ak Asset Management, Aklease, AKÖde, AgeSA, AKSigorta, MediSA and Stablex undertake non-banking financial services, capital markets and investment services.

Regardless of their location, all Akbank units and subsidiaries are subject to Group Compliance Policies. Group Compliance Policy is ensured by Board and oversight of the compliance activities are governed by high-level management committees such as Audit, Compliance and Operational Risk.

This Statement defines the Bank's risk appetite and tolerance approach which is periodically reviewed by the Board of Directors based on the periodic compliance risk assessment which determines the Bank’s compliance to regulatations, risk tolerance and strategy in the face of money-laundering, terrorist financing, sanctions and other related financial crimes risks. All strategic plans and business plans for functional areas must be consistent with this Statement.

Overview of Risk Appetite

Akbank manages these compliance risks through detailed processes, which emphasize the importance of regulatory standards, professionalism, maintaining high quality staff, and accountability to stakeholders.

Akbank maintains a robust group sanctions policy in place designed fully in line with local and global sanctions regulations imposed by OFAC, EU, UN and other relevant sanctions authorities. Akbank Group sanctions policy prohibits designated individuals and entities from participating in any possible activity through the bank, and leads to early response to recent changes in sanction regulations and policies with regard to countries and global businesses. Sanctions policy underlines our risk assessment process and risk appetite statement.

Akbank has active and preventive anti-money laundering policies to stop money-laundering attempts and takes appropriate actions. Akbank performs this active anti-money laundering approach by customer profiling and segmentation to add more analytical information to the monitoring and screening process in its periodic risk assessments.

Due to new trends and changing conditions in global compliance, Akbank does not only manages sanctions, ML and terrorist financing risks but also considers other related financial crime risks such as corruption and bribery risks in its operations.

Risk Management Framework

Due to Turkey’s geopolitical proximity to targeted sanctioned countries, Akbank does not manage only technical compliance risks inflicted by laws and regulations. It is also exposed to financial performance and reputation risk by the reason of technical noncompliance, which leads to strategic compliance risk for Akbank.

Akbank’s risk management framework seeks to ensure that there is an effective process in place to manage risk across all the operations. Risk management is integral to all aspects of Akbank’s activities and is the responsibility of all staff. Managers have a particular responsibility to evaluate their risk environment, to put in place appropriate controls and to monitor the effectiveness of those controls. The risk management culture emphasizes appropriate behaviors, analysis and management of risk in all business processes.

Coverage

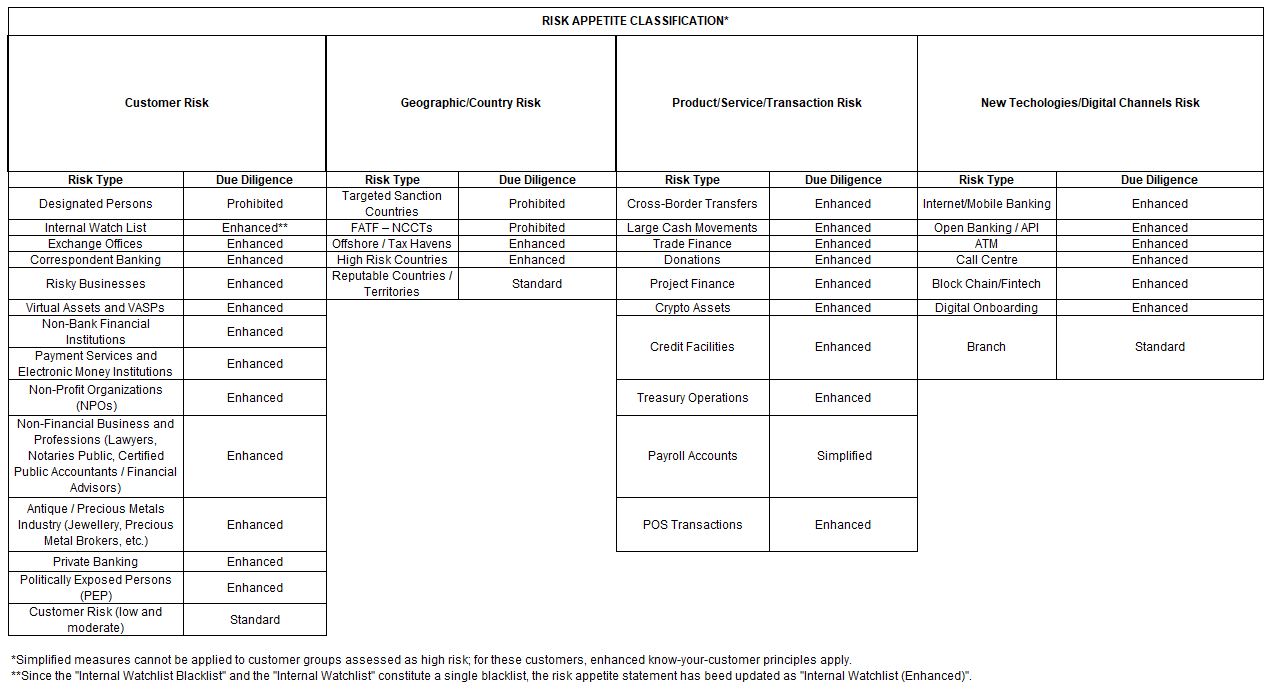

The following table describes Akbank’s Risk Appetite attitude by different stages of the customer value chain; a. Customer Risk, b. Geographic/Country Risk, c. Product/Service/Transaction, d. Technology/Delivery Channel Risk

Implementation of the Risk Appetite Statement

All Senior Managers are responsible for the implementation of, and compliance with this Statement.

a. Communication

Akbank's Risk Appetite Statement is published on Akbank’s website.

b. Risk Assessment

Akbank performs an organization-wide risk assessment process for the periodic assessment of money laundering, terrorist financing and sanction risks. The Bank’s risk assessment methodology is based on customer risk scoring elements, which is an end-to-end risk review process.

c. Reporting & Monitoring

This Statement is complemented by a “Risk Appetite Framework” where all risk tolerances are reported to the Compliance Committee and any variations outside of tolerances reported to the Board. Reporting systems are maintained to provide assurance that the risk appetite is effectively incorporated into management decisions. Feedback on the implementation of Akbank’s Risk Appetite Statement is provided through the Compliance Committee.

Review

Compliance Department reviews this Risk Appetite Statement annually, or whenever there is a significant change to Akbank’s compliance environment. The Chief Compliance Officer coordinates this review and the Board approves proposed changes to the Risk Appetite Statement.

You can also access Emerging Risk here.